Why am I, a father in his 40s, still a long way off from FIRE when so many financial bloggers are decades younger but way closer? Well, for me, it has more than a little to do with decisions made long ago that, if I had it to do again, I might have changed. The first thing I would have changed would have been to invest more when I was much younger.

The Explanation

I ought to write an article called “Dumb Money Choices I Made In My 20s That I Am Still Paying For Today”.

Heck, I could make a series out of that. https://t.co/2wsAuY3LAy

— Dads and Dollar$ (@Dads_AndDollars) July 12, 2019

I was somewhat kidding when I said I could make a series out of dumb money choices I’ve made, but when I thought about it, I realized that, well, I really did make quite a few bad decisions in my younger years. It’s kinda sobering to realize that, but for some bad decisions a long time ago, we could have been in a much more financially secure place. Unfortunately, it’s impossible to go back and correct those mistakes, but hopefully someone will listen to my story and come out a little wiser than I was back then.

Our Story

When we were in our 20s, my wife and I were doing fine, or so we thought. I had a good job with a fairly good salary; we had a decent apartment with a not-so-bad rent payment. Back then, though, we had no strategy for our money.

Don’t get me wrong: we had some investments. However, we were setting little to nothing aside from our then-current income. Almost all our investments were accounts which had been gifted to one or both of us previously, so at least we had something at the time. But we weren’t truly focused on putting money aside for later.

No, what we were doing was setting aside a very small percentage (probably just enough to get the match) in my employer’s 401(k) account.* There was a little money being saved, but not much.

And, you know, why not? We were young, and we didn’t have kids yet at that point, so why would we think about the future? It was much easier to go out to dinner once or twice a week and buy more stuff. (I think that was when we bought most of the movies we own on DVD.) There were lots of priorities, and the future was not a high one. (Thankfully, I had not developed my addiction to coffee back then, or we would be in a much worse position, I’m sure.)

Sure, I could have built up my retirement fund, but hey, now I own a bazillion DVDs. Image by Michal Jarmoluk from Pixabay

How Not Investing in Your 20s Hurts You

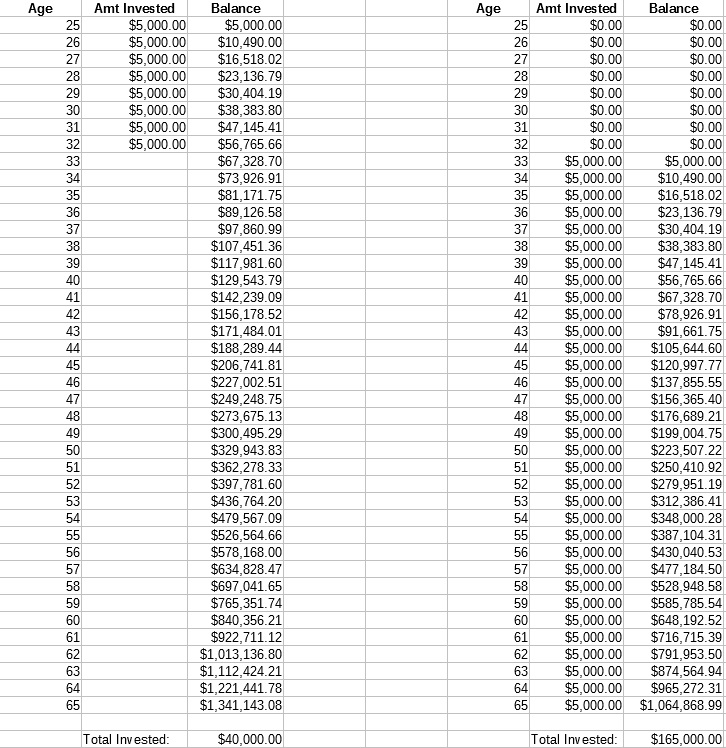

I’m sure most people who read financial blogs, books, or whatever, have seen how the power of compound interest can grow money over time. Furthermore, I’m sure most of those same people have seen the charts showing the impact of investing early as opposed to trying to catch up later. But, if you haven’t, well, here you go.

This chart assumes an annual growth of 9.8%, which is the S&P 500’s average annual growth.

(I know, I know…cheap looking chart.)

It’s always a sobering thought for me to realize that, had I invested $5000 a year for just eight years when I was younger, I could have a million dollars by age 65. It’s worse to think that if I started investing after those eight years, I could invest $5000 a year and still not catch up, assuming the market maintains its average annual growth.

And it’s even worse to think that I started a lot later than 33…and I still haven’t been putting nearly that much away per year on average.

How It Hurt Us

When we were first married, my wife and I never really thought about the fact that our expenses were going to increase over time. Now, however-many years later, we have added some children, moved into a larger home, and transitioned to much healthier (and therefore more expensive) eating. I started drinking coffee. And – stop me if you’ve heard this – we’ve also had a few medical bills.

Suffice it to say that, had we put some money aside, we would have been in a better place to handle all that.

Why I Won’t Say What We Would Have Done Differently

This would probably be the point in the post where one might expect me to say what how I would have changed things. Well, I’m not going to do that.

For one thing, the obvious thing I would have changed is right there in the post title. Invest more when I was younger? Duh!

And then, of course, I have the hindsight to know what curves life would throw at us since our 20s. I also know which financial products I wouldn’t have touched…perhaps there will be more on that point later.

The fact of the matter is that we are where we are now, and we can’t undo what we did (or didn’t do). All I can do is shine a light on my own mistakes in the hopes that someone else doesn’t repeat them.

* Oh, I may have also been putting money into company stock. Unfortunately, this was a tech company, right before the bubble burst.

Note: this post may contain affiliate links. And honestly, it probably does. View my affiliate link disclaimer here.

Great post with transparency.

I think we all wish we would have started earlier. I started working at 15 and if I had known what an index fund was at that time I would have invested.

I will definitely provide incentives for my children to open an account earlier than I did.

I appreciate you sharing this story

Thanks…hopefully, if nothing else, our children will learn from our mistakes!